PRESS RELEASE: For Release September 2017

Brad Bolinger Graduates from Kentucky Agricultural Leadership Program

Brad Bolinger of Christian County, Kentucky graduated from the Kentucky Agriculture Leadership Program (KALP) on September 7, 2017 at formal ceremonies held at Spindletop Hall in Lexington, Kentucky.

Bolinger is among twenty-two members of KALP Class XI. KALP, housed in the University of Kentucky College of Agriculture, Food and Environment, is an intensive two-year program for young agricultural producers and agribusiness individuals from Kentucky and Tennessee.

Dating back to the mid-1980s, the program was originally named the Philip Morris Agricultural Development Leadership Program, though it was never commodity specific. Philip Morris fully funded the first seven classes. Now financial supporters, including the Kentucky Agricultural Development Fund, Kentucky agribusinesses, farm organizations, program alumni and participant tuition, provide funding.

The program is not only about agriculture, but gives participants the tools to polish essential leadership skills, identify common rural and urban concerns, understand current public policy issues and establish a basis for lifelong learning and development.

Class XI had ten domestic seminars devoted to important agricultural issues. Sessions also focused on improving participants’ communication, leadership and management skills. Class members visited a variety of Kentucky agribusinesses, Frankfort, Washington D.C., California, Austria,

Slovakia, Poland and the Czech Republic to explore agriculture in different settings.

Brad Bolinger, Partner at Higgins Insurance, works as the President of Agribusiness, which provides insurance solutions to farmers, co-ops, food processors, milling facilities, as well as countless other industries involved in the agribusiness sector. He graduated with a B.S.and MBA from Western Kentucky University in 2006 & 2007 respectively. He is a member of the Christian Co. Agribusiness Association, Gideons International, and serves on the board of directors for the United Way of the Pennyrile. Brad Bolinger and his wife Fowlen Bolinger have 2 children, Isabel Blane and Soyar Pace , and are expecting their 3rd in January of 2018.

For questions or comments, contact:

Brad Bolinger

240 Remington Road

Hopkinsville, KY 42240

270-839-8646

bbolinger@higginsinsurance.com

Photo by Steve Patton, University of Kentucky College of Agriculture, Food & Environment

Photo by Steve Patton, University of Kentucky College of Agriculture, Food & Environment

Left to right: Dr. Will Snell, KALP Co-Director; Brad Bolinger,

KALP Class XI Graduate; Dr. Gary Palmer, University of Kentucky

Associate Dean for Extension; Dr. Steve Isaacs, KALP Co-Director.

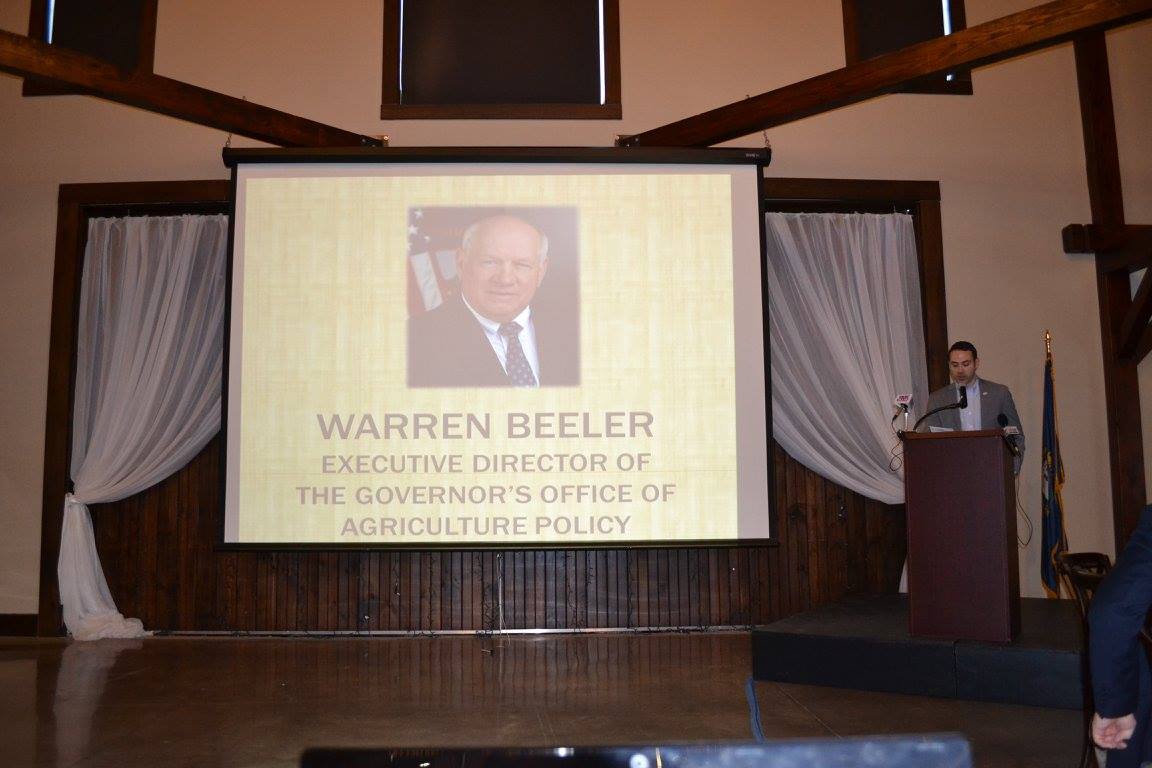

On March 21, Higgins Insurance attended the 2017 Salute to Agriculture Breakfast, where Brad Bolinger presented the 2017 Farmer of the Year award to Todd Harton and introduced speaker, Warren Beeler. Other awards that were presented included: Ag Business of the Year and Friend of Agriculture. This breakfast was held on National Agriculture Day and recognizes the large impact that Agriculture has on our community. To learn more about the 2017 Salute to Agriculture Breakfast you can go to the Christian County Chamber of Commerce Facebook page or follow this link: http://www.christiancountychamber.com/news/details/2017-salute-to-agriculture-breakfast

With so many varied businesses and areas to cover, insuring an Agribusiness can present unique challenges.

Agribusinesses are what keep our great nation running and they need to be protected properly. The hazards and risks of running a commercial agricultural enterprise are unique. This diverse industry in Kentucky and Tennessee requires a special type of care that the professionals at Higgins Insurance are qualified to supply.

Agribusinesses are generally large in size & personnel. Acknowledging that a multitude of things can go wrong is important. It is helpful to know some of the risks in order to ensure proper coverage of your business. Some of the most common agribusiness insurance claims include:

- Workers Compensation/Medical

- Property Damage

- Hail Damage

- Collision

- Lightning Damage

There are some basic areas that can be insured that will cover a majority of the risks you may encounter. Just a few of the areas of coverage that should be included in each business’ policy are:

- Commercial General Liability Insurance –

This will help protect a business from the cost of defending themselves. If a third party claims your business caused them bodily harm and/or damaged their property this insurance can cover any claims they make and any legal bills that may be incurred. - Commercial Property Insurance –

Every piece of property owned by the business will need coverage. This does not cover land alone, but can be customized to include any buildings, fields, farm equipment, processing equipment, and other properties of a business. - Business Auto Insurance –

A Business Auto Policy that covers your Agricultural operations is also customizable for each customer. Heavy duty trucks, business vehicles, and farm vehicles can be covered. Many times this can even be extended to cover private passenger vehicles owned by the farm or business. - Umbrella Insurance for Agribusiness –

Umbrella insurance protects against losses of a catastrophic nature. It is an extra layer of coverage for situations such as natural disaster, among other things.

There are many other types of coverage that can be customized to each specific business and the experts at Higgins Insurance have the knowledge and experience to make sure your business is fully prepared. It is important to keep in mind that insurance should be a proactive part of how you manage and operate your Agribusiness. Any time changes are made to your property like buildings, structures, or agribusiness operations, you should re-evaluate and update your policies.

There is no margin for error when insuring your income-producing assets and operations. Your risk management program is crucial to your long-term success and profitability. With so much at stake, you need a partner with specialized agribusiness insurance knowledge.

Contact us today and we will get you set up with one of our highly trained professionals. Call us at our Clarksville or Hopkinsville office and we can start customizing a policy for you. Remember, farming isn’t just what you do, it’s a way of life!

Hiring staff, completing inventory, ordering supplies, payroll, accounting and so much more keep business owners on their toes!

The last thing anyone wants to deal with are insurance claims.

The following is a list of the top 10 property and liability claims against businesses from insurancejournal.com that you will want to avoid!

Top 10 Property and Liability Claims

| Most Common | Most Costly |

| Burglary & Theft (20%) | Reputational Harm ($50,000) |

| Water and Freezing Damage (15%) | Vehicle Accident 3 ($45,000) |

| Wind and Hail Damage (15%) | Fire($35,000) |

| Fire (10%) | Product Liability ($35,000) |

| Customer Slip and Fall(10%) | Customer Injury or Damage ($30,000) |

| Customer Injury and Damage(Less than 5%) | Wind and Hail Damage($26,000) |

| Product Liability(Less than 5 percent) | Customer Slip and Fall ($20,000) |

| Struck by Object (Less than 5 percent) | Water and Freezing Damage ($17,000) |

| Reputational Harm (Less than 5 percent) | Struck by Object ($10,000) |

| Vehicle Accident (Less than 5 percent) | Burglary and Theft ($8,000) |

So many of these are avoidable claims and they can all be covered by business insurance. It is important to first take stock of your current business insurance situation. There is a possibility that you are under-insured against some of these common claims. You may even find that in some areas you are over-insured! You should also be sure to check the laws in Kentucky and Tennessee regarding workers’ compensation insurance, especially with higher risk businesses (such as agribusinesses or other businesses that use heavy machinery).

If you welcome customers to your office or store location, make sure that you have insurance coverage for both property and injury claims. Depending on your business, you may choose higher amounts of insurance coverage. Our knowledgeable agents at Higgins Insurance are happy to help you determine how much coverage you will need.

Don’t wait until you are dealing with an accident or insurance claim to look into the proper insurance. Although sometimes a high premium may deter people from purchasing the correct amount of insurance, you can lower the premium by selecting a higher deductible rate.

If you have questions about business insurance, would like a business insurance quote, or want to talk about your current rates, contact Higgins Insurance today! For your convenience, we have offices located in both Hopkinsville, Kentucky and Clarksville, Tennessee. Our team, at both locations, are ready to help with all of your business insurance needs. Call our toll free number (888) 457-2307 to set up an appointment.

At Higgins Insurance we are dedicated to protecting the things you love most. Since 1897, we have been protecting your family, your business, and your future. You can count on us!

Higgins Insurance attended the local Eye Opener Breakfast in Salute to Agriculture on March 18th.